– Closed on Two Multifamily Assets for $307 Million –

– Leased 375K Square Feet in Fourth Quarter and 1 Million Square Feet in 2021 –

– Repurchased $37.9 Million of Shares in Fourth Quarter and $191.6 Million Since March 2020 –

Multifamily Asset Acquisition

On December 22, 2021, the Company completed the recapitalization of 625 units in two multifamily assets, the Victory (561 10th Avenue) and 345 East 94th Street, previously owned by a joint venture of Fetner Properties, Inc. and an institutional owner. Fetner Properties will retain a 10% equity stake and will continue to manage onsite operations. ESRT will asset manage the properties, make all decisions, and has the right to assume day-to-day management for no additional consideration. The total transaction value is $307 million, inclusive of $134 million of debt on the Victory, that matures in 2033 and has an effective interest rate of 3.82%, and $52 million of debt on 345 East 94th Street, that matures in 2030 and has an effective interest rate of 3.46%.

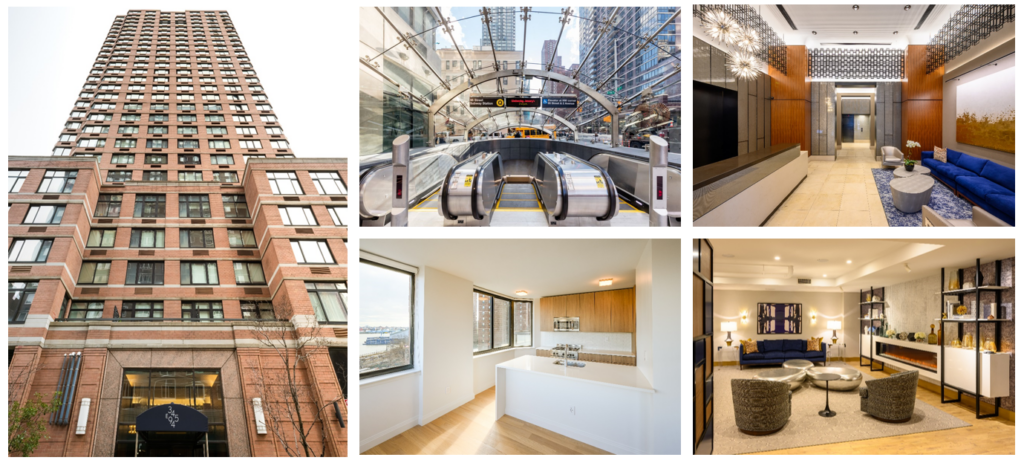

The Victory is a 417 unit, 45-story apartment building at the corner of 10th Avenue and 41st Street near Hudson Yards. It is a participant in an extendable 421a tax abatement program. The Class A, 310,707 square feet asset offers a mix of studio, 1- and 2-bedroom units and a full suite of amenities including 24-hour concierge, fitness center with half-court basketball, resident lounge with outdoor terraces, roof deck and parking, as well as an 11,000 square feet retail space leased to CVS through 2040.

345 East 94th Street is a 208 unit, 30-story, apartment building at the corner of 1st Avenue and 94th Street near the 2nd Avenue subway line at 96th Street. It is a participant in an extendable 421a tax abatement program. The Class A, 168,243 square feet asset offers a mix of studio, 1- and 2- bedroom units and a full suite of amenities including a 24-hour concierge, fitness center, resident lounge, outdoor terrace and parking.

“We are delighted to partner with Hal Fetner and his organization and are very happy that our investment team led by Aaron Ratner identified and negotiated a transaction consistent with our previously stated focus on NYC office, retail and multifamily assets. These well located, well amenitized assets will be accretive to FFO in 2022,” stated Anthony E. Malkin, Empire State Realty Trust’s Chairman, President and Chief Executive Officer.

“Fetner Properties is excited to be working with our new partner, Empire State Realty Trust. We will continue to manage these assets as they are recapitalized and repositioned for continued success,” said Hal Fetner, President and CEO, Fetner Properties. “ESRT and Fetner’s residential abilities and expertise, with each company’s longstanding commitment to New York City, are a strong foundation on which to build.”

The Victory (561 10th Avenue)

345 E 94th Street

Leasing Update

Lionel Uzan, President of Clarins North America, said “We have made the decision to relocate our New York Headquarters Office to 1400 Broadway to be in a more energy-efficient building that aligns with our corporate responsibility values. We intend to design a modern and versatile work environment to reflect the new needs of a mobile and agile workforce to foster collaboration, creativity, and social interactions, all in a more centrally-located area.”

Observatory Update

In the fourth quarter of 2021, the Observatory hosted approximately 360,000 visitors, compared to 255,000 visitors in the third quarter 2021. Fourth quarter attendance met our hypothetical target of approximately 40% of 2019 comparable period attendance. ESRT has provided an updated hypothetical Observatory admissions forecast for 2022 in its updated investor presentation.

Share Repurchase Authorization and Activity

In the fourth quarter 2021, the Company repurchased $37.9 million of its common stock at a weighted average price of $9.44 per share. This brings the cumulative total to $191.6 million at a weighted average price of $8.59 per share, which represents approximately 7.5% of total shares outstanding as of March 5, 2020, the date our share buyback program began.

The Company’s Board of Directors approved a new repurchase authorization of up to $500 million of the Company’s Class A common stock and Empire State Realty OP, L.P.’s Series ES, Series 250 and Series 60 operating partnership units (NYSE Arca: ESBA, FISK and OGCP, respectively) for the period of January 1, 2022 through December 31, 2023.

Updated Investor Presentation

The Company has posted on the “Investors” section of its website (www.esrtreit.com) the latest investor presentation, which contains year-end observatory updates, additional details on the acquisition, and other information.

About Empire State Realty Trust

Empire State Realty Trust, Inc. (NYSE: ESRT) is a NYC-focused REIT that owns and manages a well-positioned property portfolio of office, retail and multifamily assets in Manhattan and the greater New York metropolitan area. Owner of the Empire State Building, the World’s Most Famous Building, ESRT also owns and operates its iconic, newly reimagined Observatory Experience. The company is a leader in healthy buildings, energy efficiency, and indoor environmental quality, and has the lowest greenhouse gas emissions per square foot of any publicly traded REIT portfolio in New York City. As of Dec. 31, 2021, ESRT’s portfolio is comprised of 9.4 million rentable square feet of office space, and approximately 700,000 rentable square feet of retail space. More information about Empire State Realty Trust can be found at esrtreit.com and by following ESRT on Facebook, Instagram, Twitter and LinkedIn.

About Fetner Properties

Fetner Properties is a full-service, fully integrated real estate company that owns develops, and manages residential properties in Manhattan and Long Island City. Fetner Properties has created communities in New York City since 1955, through three generations of family ownership.

Forward-Looking Statements

This press release includes “forward looking statements” within the meaning of the federal securities laws. You can identify these statements by use of words such as “assumes,” “believes,” “estimates,” “expects,” “intends,” “plans,” “projects” or similar words or expressions that do not relate to historical matters. You should exercise caution in interpreting and relying on forward-looking statements, because they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond the Company’s control and could materially affect actual results, performance or achievements. These factors include, without limitation, the risks and uncertainties detailed from time to time in the Company’s filings with the SEC and any failure of the conditions or events cited in this release. Except as may be required by law, the Company does not undertake a duty to update any forward-looking statement, whether as a result of new information, future events or otherwise.

Contact:

Investors

Empire State Realty Trust Investor Relations

(212) 850-2678

Category: FINANCIAL

# # #